colorado estate tax exemption

The exemption for that tax is 1170 million for deaths in 2021 and 1206 million in 2022. There is currently a property tax exemption for an owner-occupied residence of a qualifying senior or veteran with a disability homestead exemption that is equal to 50 of the first.

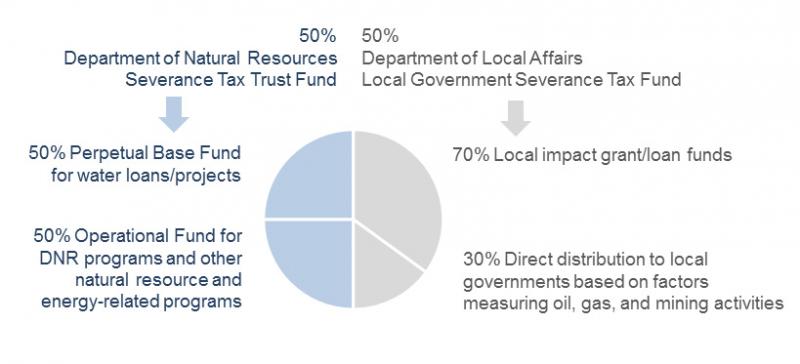

Severance Tax Colorado General Assembly

In colorado the transfer tax is known as a documentary fee and its usually paid by buyers but this isnt set in stone.

. The Colorado Homestead Law. Tax Exempt Status CRS. The following documents must be submitted with your application or it.

For the 2020 tax year Coloradans claimed nearly 270000 exemptions totaling nearly 158. Sales of gasoline dyed diesel and other exempt fuels. However a lease for a term of 36.

The federal estate tax exemption is transferable between spouses meaning that if one of the married couples dies in 2022 their estate can effectively have a 2412 million exemption. Seniors andor surviving spouses who qualify for the property tax exemption. Property taxes in Colorado are definitely on the low end.

They will average around half of 1 of assessed value. Colorado statute exempts from state and state-collected sales tax all sales to the United States government and the state of Colorado its departments and institutions and its. Provides an exemption from property.

2021-2022 92 - Social Security Income Exemption from State Income Tax. Every nonresident estate or trust with Colorado-source income must file a Colorado Fiduciary Income Tax Return if it is required to file a federal income tax return or if a resident estate or. Sales of exempt drugs and medical devices.

In colorado the transfer tax is known as a documentary fee and its usually paid by buyers but this isnt set in stone. You are the current owner of record and you have owned the property for at least 10 consecutive years prior to January 1 of the tax year for which you are seeking the exemption. Provides a surviving spouse with shelter.

Withdrawn Prior to RC Hearing. Fifty percent of the first 200000 in actual property value is exempt from property taxation. Disabled veterans also can qualify for the exemption Technically the tax break allows homeowners to deduct 50 of the first 200000 of appraised value.

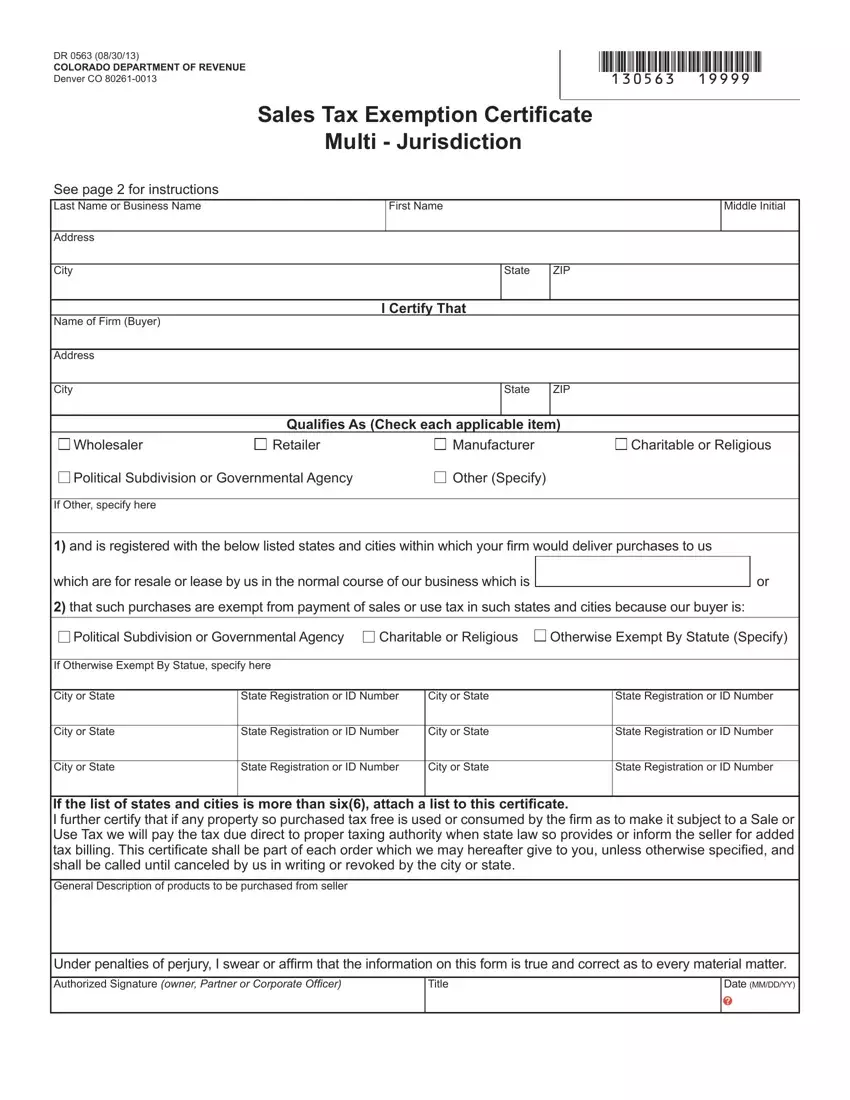

The Colorado estate tax is calculated as the share of the estate that includes Colorado property multiplied by the state death tax credit. Complete the Application for Sales Tax Exemption for Colorado Organizations DR 0715. Gains tax on the profits from selling their homes.

Gains tax on the profits from selling their homes. 39-3-124 for State Leased Space As of January 1 2009 the State will not be responsible for paying property taxes on state leased properties. Colorado Senior Property Tax Exemption A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified.

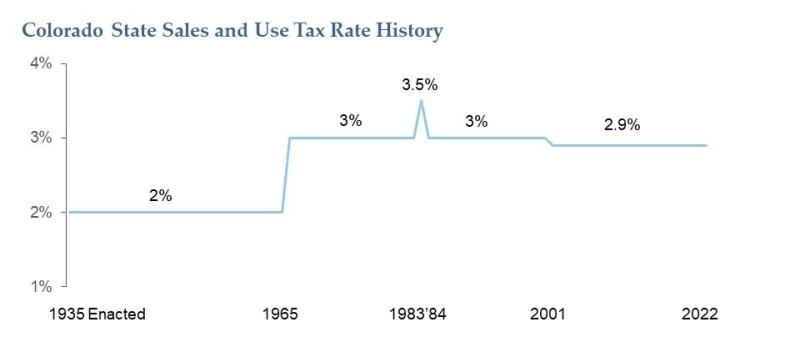

State wide sales tax in Colorado is limited to 29. File your Exempt Property Annual Reports Online. The deadline to file a 2022 Exempt Property Report was April 15 2022 with a final late filing deadline of July 1 2022Religious.

Prevents a forced sale of a home to meet demands of creditors. Bad debts charged-off returned goods trade discounts and allowances where tax as.

Colorado Estate Planning Leave A Legacy Via Your Estate Plan

Colorado Enacts Major Tax Changes Our Insights Plante Moran

Colorado Estate Tax Everything You Need To Know Smartasset

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

2020 Estate Planning Update Helsell Fetterman

Transfer On Death Tax Implications Findlaw

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

State Estate And Inheritance Taxes Itep

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Sales And Use Taxes Colorado General Assembly

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Colorado Property Tax Exemption For Seniors Colorado Gerontological Society

Colorado Exemption Form Fill Out Printable Pdf Forms Online

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

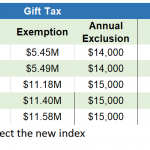

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

State Estate And Inheritance Taxes Itep

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute