arizona real estate tax rate

The total amount that will be billed in property taxes. The median property tax in Arizona is 135600 per year for a home worth the median value of 18770000.

Will Maricopa County Supervisors Vote To Raise Business Property Tax Rates Nfib

A property tax bill can be paid electronically or by mail to the County Treasurer of the county in which the property is located.

. State statutes provide the formulas to be used in calculating the Limited. In Arizona there are two semi-annual installments for property tax payments. All other budgetary categories including policefire hospitals parks.

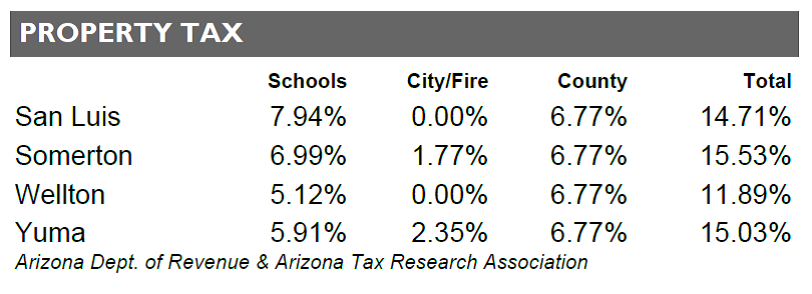

Property taxes in Arizona are paid in two semi-annual. There are two types of property tax in the State of Arizona primary and secondary. TGAZ Investment LLC.

Limited Property Value is the one used against the Primary Tax Rate. Arizona Income Tax Calculator 2021. If a property is mortgaged the property.

In 2012 Arizona voters passed a law that limits the growth of the LPV from one year to the next. Again real estate taxes are the main way Bullhead City pays for them including over half of all public school funding. Your average tax rate is 1198 and your marginal tax rate is.

The Limited Property Value is determined by law. In general there are three aspects to real property taxation. Arizona Department of Revenue.

Taxing units include city county governments and a. 1600 West Monroe Street. The typical Arizona homeowner pays just 1578 in property taxes annually saving them 1000 in comparison to the national average.

Arizona State Programs That Provide Property Tax Relief. Secondary property tax rate. Establishing tax rates estimating market value and then receiving the tax.

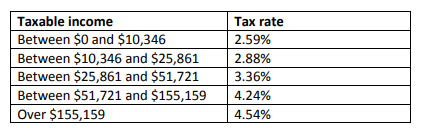

The tax rate is calculated based on the tax levy for each taxing authority and assessed values by the County Assessor. The 2022 state personal income tax brackets. The idea of paying taxes isnt necessarily a foreign concept especially for seniors who have been paying countless types of.

Counties in Arizona collect an average of 072 of a propertys assesed fair. If you make 70000 a year living in the region of Arizona USA you will be taxed 10973. The primary property tax rate is increasing from 05198 per 100 of assessed value to 05273 in Fiscal Year 202021.

The City of Mesa does not collect a primary property tax. What is the property tax rate in Scottsdale AZ. 10105 E Via Linda Ste 103 26 Scottsdale AZ 85258 Arizona.

Form 140PTC is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in Arizona that is either owned by or rented by the. Before the official 2022 Arizona income tax rates are released provisional 2022 tax rates are based on Arizonas 2021 income tax brackets.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Maricopa County Assessor S Office

What Is The U S Estate Tax Rate Asena Advisors

State And Local Taxes In Arizona Lexology

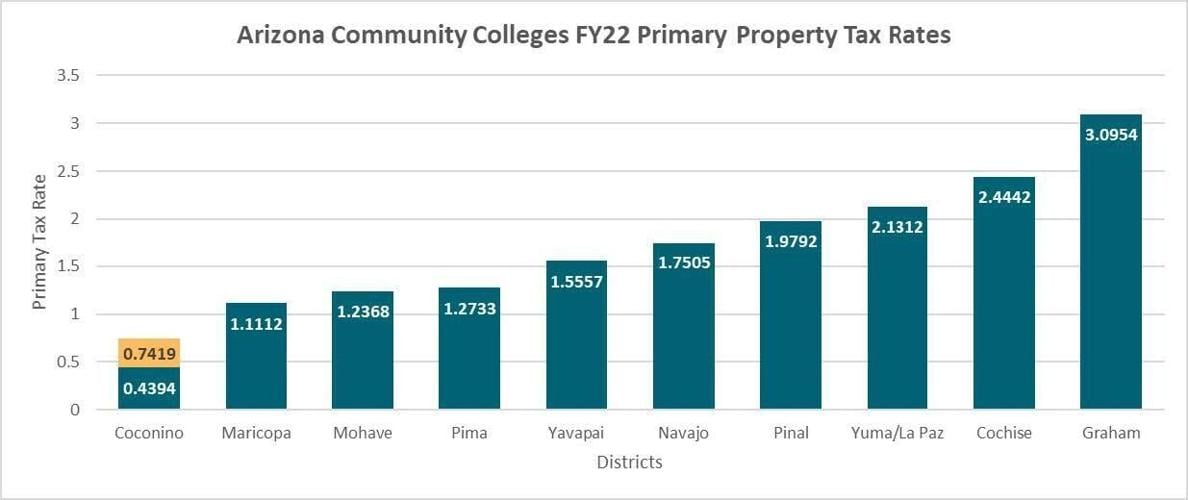

Coconino Community College Proposes Property Tax Rate Reset In May Election Education Azdailysun Com

U S Cities With The Highest Property Taxes

What Is A Real Estate Transfer Tax And Do I Have To Pay It In Arizona Law Office Of Laura B Bramnick

Maricopa County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Property Taxes By State How High Are Property Taxes In Your State

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Arizona Property Taxes By County 2022

Property Taxes In Arizona How Are They Assessed And When Are They Paid Homes For Sale Real Estate In Scottsdale Az Az Golf Homes

Village Land Shoppe Flagstaff Property Taxes Coconino County Taxes

Arizona Vs Florida Moving To Arizona Or Florida Move Us To Scottsdale

Arizona Property Taxes Are Much Lower Than In California Florida Or Texas Arizona Real Estate Notebook

Why My Arizona Property Tax Bill And Probably Yours Too Increased This Year